Cryptocurrency and divorce

by Family Law Attorney Rylee Broyles

These days, Bitcoin and other cryptocurrencies1 are all the rage. As such, the issue of bitcoin is bound to pop up in divorce cases. While the idea of dividing bitcoin as a marital asset might be a foreign and daunting concept to divorce practitioners (especially the less tech savvy among us), it should not be feared and it certainly should not be overlooked. This article explains the importance of understanding bitcoin (at least the general workings of it) and how to ensure bitcoin is properly accounted for as a marital asset.

First things first: what is bitcoin? Essentially, bitcoin is a digital currency that can be bought, sold and exchanged. Unlike traditional currency, bitcoin is decentralized because it does not rely on a central bank, nation state or regulatory authority, and it does not rely on gold or silver as a basis of value.

Most people buy bitcoin via cryptocurrency exchanges that allow users to buy, sell and hold cryptocurrency. Popular exchange platforms include Coinbase, Kraken and Gemini. Once a user purchases bitcoin, they will need a bitcoin wallet to store it. A “hot wallet” (also called an online wallet) is stored by an exchange or a provider in the cloud. Providers of online wallets include Exodus, Electrum and Mycelium. A “cold wallet” (or mobile wallet) is an offline device used to store bitcoin that is not connected to the internet. Some mobile wallet options include Trezor and Ledger.

While bitcoin can be used to make purchases, people generally use it as an alternative investment to diversify their portfolio apart from stocks and bonds.2 However, bitcoin value can be volatile. As such, holding bitcoin as an investment is typically riskier than traditional investments. Some financial planners have coined such crypto-investments as a “Vegas account” because they can be such a gamble.

Now that we have a general understanding of what bitcoin is, what’s next? For divorce practitioners, the answer is to figure out if (and how much) bitcoin is a part of the marital estate.

At the outset of a matter, practitioners should question clients to determine whether bitcoin may play a role in the divorce. Such inquiries might include whether the client or their spouse (a) is tech savvy; (b) has ever bought or sold bitcoin; and (c) has ever received bitcoins in exchange for goods and services.

If there is a history of bitcoin ownership, further inquiries include:

- How did the client or spouse store or transact in bitcoins?

- Where are important records kept, and does the client have access to them?

- What electronic devices does the client or spouse own?

- Does the client have physical access to such electronic devices?

- A practitioner should also examine bank and credit card statements to see if there are any payments to bitcoin exchanges (e.g. Coinbase).

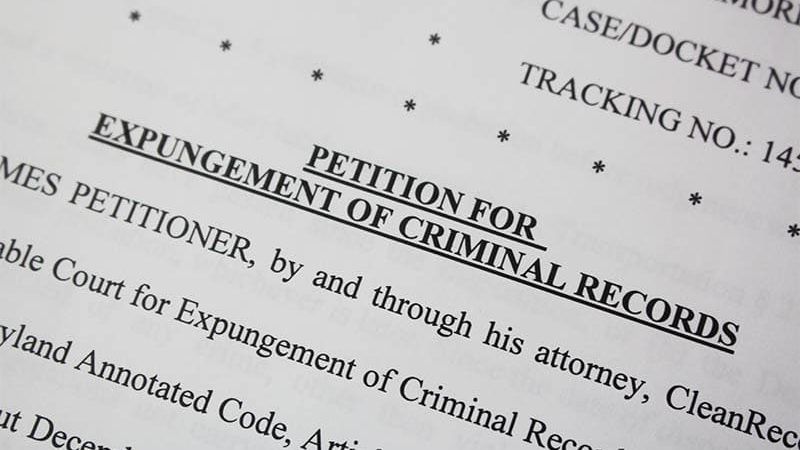

If the practitioner determines bitcoin discovery is warranted, the first step is to send a preservation letter to the spouse’s attorney reminding the spouse to preserve evidence on phones and computers. The next step is to draft discovery that will adequately identify cryptocurrency assets of the adverse party. When drafting discovery, practitioners should tailor interrogatories and requests for production to include bitcoin information. A practitioner may also simply add questions below their traditional discovery specifically targeted at bitcoin.

Potential interrogatory questions include:

- Do you own or have you ever owned any form of cryptocurrency? and

- Identify your public and/or private key for any cryptocurrency you own or possess.

Potential requests for production include:

- Produce all documents regarding detailed account activity for any and all Coinbase accounts or any other overseas exchange e-wallet accounts held solely or jointly in the name of ____________; and

- Produce all documents regarding storing, buying, selling, trading, exchanging, sending, receiving or using cryptocurrencies in any and all Coinbase accounts or any other exchange e-wallet accounts held solely or jointly in the name of ____________.

These discovery requests are a few examples of how practitioners can identify the existence and location of bitcoin.

Once discovery is completed, if additional information is needed to determine the full scope of the crypto-asset, practitioners can utilize business record subpoenas (to Coinbase or other accounts) and other tools they would ordinarily use to get at other assets such as bank accounts and stocks.

Bitcoin should not strike fear in the hearts of practitioners. Instead, it should be included in every practitioner’s asset checklist to ensure that all marital property is properly accounted for. Understanding how bitcoin works and where it is located, and including it in discovery inquiries is the best way to successfully account for the crypto-asset in divorce matters.

Notes:

- For ease, this article will refer to cryptocurrencies collectively as “bitcoin” whereas “Bitcoin” refers to the actual cryptocurrency with that name.

- A word of caution: when bitcoin is used as currency, rather than an investment, there are certain tax implications users should be aware of. Such implications are outside the scope of this article.

Sources:

https://www.forbes.com/advisor/investing/what-is-bitcoin/

https://www.coinbase.com/learn/crypto-basics/

A Divorce Practitioner’s Bitcoin Primer

About Joseph, Hollander & Craft LLC

Joseph, Hollander & Craft is a premier law firm representing criminal, civil and family law clients throughout Kansas and Missouri. When your business, your freedom, your property, or your career is at stake, you want the attorney standing beside you to be skilled, prepared, and relentless. From our offices in Kansas City, Lawrence, Overland Park, Topeka and Wichita, our team of 20+ attorneys has you covered. We defend against life-changing criminal prosecutions. We protect children and property in divorce cases. We pursue relief for victims of trucking collisions and those who have suffered traumatic brain injuries due to the negligence of others. We fight allegations of professional misconduct against doctors, nurses, judges, attorneys, accountants, real estate agents and others. And we represent healthcare professionals and hospitals in civil litigation.